Budgeting for a successful future

Managing your finances effectively is a crucial aspect of achieving financial stability and success in life. Whether you’re saving for a big purchase, building an emergency fund, or planning for retirement, mastering the art of budgeting and money management is key. In Australia, a country known for its high cost of living, these skills become even more vital. In this article, we’ll provide you with smart financial money and budgeting tips tailored to the Australian context.

Create a Detailed Budget

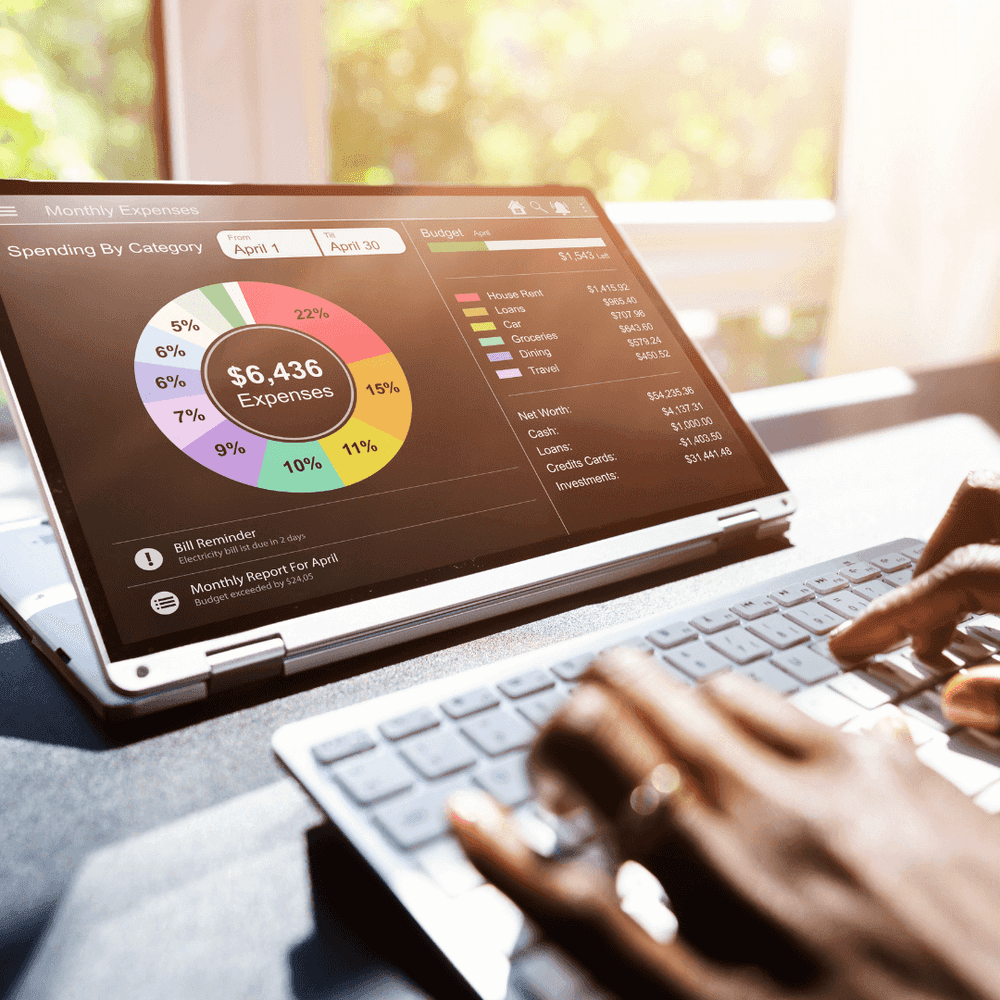

The foundation of sound financial management is a well-structured budget. Start by tracking your income and expenses. List your sources of income, such as your salary, freelance work, or rental income. Then, categorise your expenses, including rent or mortgage payments, groceries, utilities, transportation, entertainment, and savings.

Prioritise Savings

In Australia, having a financial safety net is essential. Begin by establishing an emergency fund that covers at least three to six months’ worth of living expenses. This fund will provide peace of mind and financial security in case of unexpected events like medical emergencies or job loss.

Additionally, consider setting up a high-interest savings account to grow your wealth. Look for accounts with competitive interest rates and no or low fees. Automate your savings by setting up regular transfers from your checking account to your savings account.

Superannuation Planning

Australia has a compulsory superannuation system, where employers must contribute a portion of your salary to a superannuation fund. Take advantage of this system by regularly reviewing your superannuation account. Consolidate multiple accounts if you have them, as multiple accounts can lead to unnecessary fees.

Consider making additional voluntary contributions to your superannuation, especially if you can afford it. This can have significant long-term benefits and may reduce your tax liability.

It is best to speak with one of our financial planners before making any decisions.

Reduce Debt

High-interest debt, such as credit card balances and personal loans, can hinder your financial progress. Focus on paying off these debts as quickly as possible. Consider debt consolidation or balance transfers to lower interest rates.

Always pay your credit card bills on time to avoid late fees and interest charges. If you consistently struggle with credit card debt, it might be wise to switch to a debit card or a cash-only system to curb overspending.

Invest Wisely

Investing can help your money grow over time and build wealth for your future. Consider investing in a diversified portfolio of stocks, bonds, and other assets. Seek the advice of a qualified financial advisor or do thorough research before making investment decisions.

In Australia, take advantage of tax-advantaged investment options like the Stock Exchange of Australia (ASX) and the Australian Government Bonds. Remember that investing involves risks, so it’s essential to have a long-term perspective and a diversified strategy.

Review Insurance Coverage

Protecting yourself and your assets through insurance is vital. Regularly review your health insurance, car insurance, home insurance, and any other coverage you may have. Ensure that your policies provide adequate coverage and consider bundling policies to save on premiums.

Minimise Lifestyle Inflation

As your income grows, it’s tempting to increase your spending on lifestyle upgrades. While enjoying the fruits of your labour is important, be mindful of lifestyle inflation. Avoid unnecessary expenses and stick to your budgeting principles, allocating extra income to savings, investments, and debt reduction.

Smart financial money and budgeting tips are essential for anyone living in Australia. By creating a detailed budget, prioritising savings, optimising your superannuation, reducing debt, investing wisely, reviewing insurance coverage, and avoiding lifestyle inflation, you can achieve financial stability and build a secure future.

To find out how you can become financially free, get in touch with our financial planning team today!

The information on the Proacct+ website is intended to be general in nature and is not personal financial product advice. It does not consider your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant product disclosure statement (PDS) or other offer document prior to making an investment decision in relation to a financial product (including a decision about whether to acquire or continue to hold).